DSO Corporate Tax Registration Services in UAE

DSO Corporate Tax Registration Services in UAE

The introduction of UAE Corporate Tax has made corporate tax registration a mandatory legal requirement for all companies licensed in Dubai Silicon Oasis (DSO). Regardless of your company’s business activity, revenue, or profitability, every DSO-registered entity must register for corporate tax with the Federal Tax Authority (FTA) within the prescribed timelines.

At UAE Corporate Tax Registration, we provide end-to-end DSO corporate tax registration services, ensuring your business meets all UAE corporate tax compliance requirements accurately and on time—without errors, delays, or penalties.

Corporate Tax in Dubai Silicon Oasis (DSO) – Overview

UAE Corporate Tax is governed by Federal Decree-Law No. 47 of 2022, which applies to all business entities operating in the UAE, including Free Zones such as Dubai Silicon Oasis.

Key Points for DSO Companies:

Corporate tax registration is mandatory

Registration is required even if your company qualifies for 0% corporate tax

DSO companies may be eligible as Qualifying Free Zone Persons (QFZP)

Failure to register can result in FTA administrative penalties

Being licensed in a Free Zone does not remove the obligation to register for corporate tax.

Who Must Register for Corporate Tax in DSO?

Corporate tax registration applies to all legal entities licensed under DSO, including:

DSO Free Zone companies

Technology, IT, software, and innovation-focused businesses

Startups, SMEs, and multinational companies

Consultancy and service providers

Holding and investment companies

Branches registered in Dubai Silicon Oasis

Even if your company:

Has not started operations

Has no revenue or profits

Qualifies for corporate tax exemptions

👉 Corporate tax registration is still mandatory.

Qualifying Free Zone Person (QFZP) in DSO

Many DSO companies may qualify for a 0% corporate tax rate under the Qualifying Free Zone Person (QFZP) regime.

QFZP Conditions Include:

Maintaining adequate economic substance in the UAE

Generating qualifying income

Not conducting excluded activities

Complying with transfer pricing rules

Filing corporate tax returns on time

⚠️ Important:

QFZP status does not eliminate the obligation to register for corporate tax. Proper registration is required to benefit from Free Zone incentives.

Our experts assess eligibility and ensure accurate classification during registration.

Our DSO Corporate Tax Registration Services

We offer a complete, done-for-you solution for DSO corporate tax registration, tailored to your business structure and compliance needs.

Our Services Include:

1. Corporate Tax Applicability Assessment

Review of business activities and legal structure

Identification of corporate tax obligations and Free Zone benefits

2. FTA Portal Registration

Creation and configuration of your FTA account

Submission of corporate tax registration application

3. Documentation Review & Submission

Verification of required documents

Accuracy checks to prevent delays or rejection

4. Corporate Tax TRN Issuance

Confirmation of Corporate Tax Registration Number (TRN)

Guidance on post-registration compliance

5. Ongoing Corporate Tax Advisory

Filing deadlines and compliance reminders

Continued corporate tax support when required

Documents Required for DSO Corporate Tax Registration

To register for corporate tax, the following documents are typically required:

Valid DSO trade license

Memorandum & Articles of Association (MOA/AOA)

Passport and Emirates ID of shareholders/managers

Company contact details

Financial year information

Description of business activities

We assist you in preparing and reviewing all documentation for smooth processing.

Why Choose UAE Corporate Tax Registration for DSO?

We focus exclusively on UAE corporate tax compliance and understand the regulatory requirements of Dubai World Central Free Zone.

✔️ Our Key Advantages:

Specialized DSO & Free Zone expertise

FTA-compliant registration process

Fast and accurate application handling

Transparent pricing with no hidden fees

Dedicated corporate tax consultants

Our goal is to safeguard your business from penalties and ensure long-term compliance.

Corporate Tax Registration Deadlines for DSO Companies

Corporate tax registration deadlines are determined by the FTA based on:

Trade license issuance date

Legal structure

Financial year

Failure to register within the assigned timeframe can result in administrative penalties, even if no tax is payable.

We ensure your DSO registration is completed on time.

Penalties for Non-Compliance

Failure to comply with corporate tax registration requirements may lead to:

FTA administrative penalties

Increased audit risk

Compliance challenges during license renewal

Financial and reputational consequences

Early registration helps eliminate unnecessary risk.

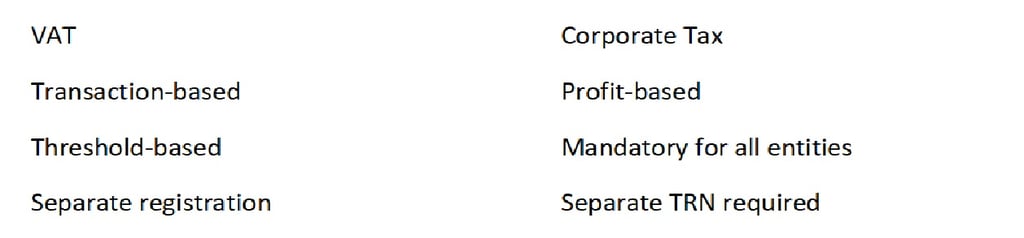

Corporate Tax vs VAT – Key Differences

Corporate tax registration is separate from VAT registration.

VAT registration does not cover corporate tax obligations.

How Long Does DSO Corporate Tax Registration Take?

In most cases:

3–7 working days, depending on documentation readiness and FTA review

Our efficient process minimizes delays and ensures timely approval.

Post-Registration Corporate Tax Compliance

After registration, DSO companies must:

Maintain proper accounting records

File annual corporate tax returns

Comply with transfer pricing regulations (if applicable)

Retain documentation for FTA audits

We provide ongoing compliance support upon request.

Get Started with DSO Corporate Tax Registration Today

Corporate tax registration is a legal requirement for all DSO companies — but it doesn’t have to be complicated.

At UAE Corporate Tax Registration, we provide reliable, compliant, and efficient DSO corporate tax registration services tailored to your business needs.

👉 Contact us today to ensure timely registration and full FTA compliance.

Contact Us

📞 +971 4 396 7982

✉ info@guptagroupinternational.com

Useful Links

Services | About | Resources | Careers | Contact

Legal

Privacy Policy | Cookie Policy | Terms of Use | Disclaimer

© 2001–2026 Gupta Group International